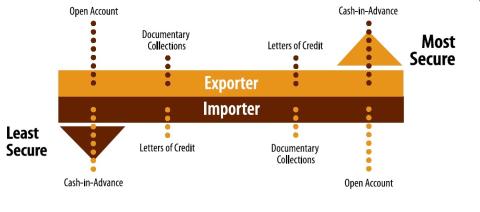

Payment Methods in Import Export Business Explained

Getting paid reliably is as important as delivering the goods. Below are the common payment methods used in international trade with a clear, step-by-step explanation, risks, pros/cons and when to use each.

1. Advance Payment (Cash in Advance)

What it is: Buyer pays (partially or fully) before seller ships goods.

- Buyer and seller agree terms (e.g., 30% advance, 70% on shipment).

- Buyer makes payment to seller’s bank account or via an agreed payment platform.

- Seller confirms receipt, arranges production and shipment.

Pros: Zero payment risk for exporter; simple.

Cons: Buyer bears risk — hard to find buyers for new relationships.

Best for: New buyers, custom/small production, high-risk markets.

2. Open Account

What it is: Seller ships first; buyer pays later per agreed credit terms (e.g., 30/60/90 days).

- Agree credit terms in sales contract.

- Seller ships and sends invoice and documents to buyer.

- Buyer pays on the due date.

Pros: Attractive to buyers, increases competitiveness.

Cons: High risk for seller (non-payment). Requires trust or mitigation (insurance).

Mitigations: Trade credit insurance, factoring, buyer credit checks, letters of credit if risk changes.

3. Documentary Collection (through banks) — D/P and D/A

What it is: Seller’s bank forwards shipping documents to buyer’s bank with instructions to release documents against payment (D/P) or acceptance (D/A).

D/P — Documents Against Payment

- Seller ships goods and presents documents to their bank (remitting bank).

- Remitting bank sends documents to the buyer’s bank (collecting bank) with instructions D/P.

- Buyer pays the collecting bank; documents (title) are released so buyer can clear goods.

Risk: Buyer may refuse to pay — seller retains title but not cargo.

D/A — Documents Against Acceptance

- Same as above but collecting bank releases documents when buyer accepts a bill of exchange (a promise to pay later).

- Seller must pursue payment later or rely on accepted bills (credit risk).

Pros: Cheaper than LC, better for established relationships.

Cons: Less secure than LC — payment is not guaranteed by banks (except for D/P immediate payment).

4. Letter of Credit (LC) — Step by Step

What it is: Bank guarantees payment to the seller if seller meets documentary terms specified in the LC. LCs are governed by UCP rules in most cases.

- Buyer and seller agree to use LC in the contract and specify LC terms (amount, expiry, documents required).

- Buyer applies to their bank (issuing bank) to open the LC in favor of the seller.

- Issuing bank issues LC and forwards to the advising/confirming bank (seller’s bank).

- Seller ships goods and presents documents to the advising/confirming bank.

- Bank checks documents against LC terms. If compliant, bank pays (at sight) or accepts bill of exchange (usance LC).

- Issuing bank reimburses the advising/confirming bank; buyer reimburses issuing bank per agreement.

Types & notes: Irrevocable LC (commonly used), confirmed LC (adds seller’s bank guarantee), transferable LC, standby LC (acts like a bank guarantee).

Pros: High security for seller, banks handle documentary payment.

Cons: Costly (bank fees), strict documentary compliance — discrepancies can delay payment.

Best for: New trading relationships, high-value shipments, or when seller needs bank guarantee.

5. Consignment

What it is: Seller ships goods but payment is only made when goods are sold by the consignee (buyer or agent) in the destination market.

- Seller ships goods to consignee and retains legal title under agreed terms.

- Consignee sells goods locally and remits proceeds per agreed schedule (after commission/deductions).

Pros: Encourages buyer to stock more; useful to penetrate new markets.

Cons: Very high risk for seller — payment depends on final sale; use only with trusted partners.

6. Bank Guarantees & Standby Letters of Credit (SBLC)

What they are: Bank guarantees assure performance or payment. SBLC functions as a fallback payment mechanism if buyer fails to pay under the primary contract.

- Buyer’s bank issues guarantee in favor of seller.

- If buyer defaults, seller claims under guarantee by presenting required documents.

Use cases: Performance guarantees, advance payment guarantees, bid bonds, and standby LCs for high-value contracts.

7. Escrow Services & Online Payment Platforms

What they are: A neutral third-party (escrow provider or payment gateway) holds funds until contract conditions are met.

- Buyer deposits funds in escrow when order is placed.

- Seller ships and uploads proof (tracking, documents).

- Escrow releases funds to seller when predefined conditions are satisfied.

Pros: Good for B2C/B2B e-commerce, reduces buyer/seller mistrust.

Cons: Fees, not always suitable for large commercial shipments unless specialized escrow/trade platforms are used.

8. Trade Finance: Factoring, Forfaiting & Supply Chain Finance

- Factoring: Seller sells receivables (invoices) to a factor for immediate cash (less fee). Useful with open account terms.

- Forfaiting: Exporter sells medium/long-term receivables (usually backed by LC or promissory notes) to a forfaiter without recourse.

- Supply Chain Finance / Reverse Factoring: A bank or platform pays the seller early based on buyer credit quality; buyer pays bank later.

Benefits: Improves seller cash flow, reduces buyer payment friction.

9. Card Payments & Digital Wallets (B2C / small B2B)

For smaller cross-border sales, payment via cards, PayPal, Stripe, or other payment gateways is common. Advantages: speed and convenience. Limitations: fees and chargeback risk.

10. How to Choose the Right Payment Method — Quick Decision Guide

- Priority = Payment security: Use Advance Payment, Confirmed LC, or Bank Guarantee.

- Priority = Competitiveness / Buyer credit: Use Open Account + credit insurance or Supply Chain Finance.

- New buyer / unknown market: Prefer LC or advance payment.

- Established buyer / low risk: Open account or D/P may be acceptable.

- Large capital goods / long credit term: Forfaiting or SBLC might suit.

11. Practical Tips to Reduce Payment Risk

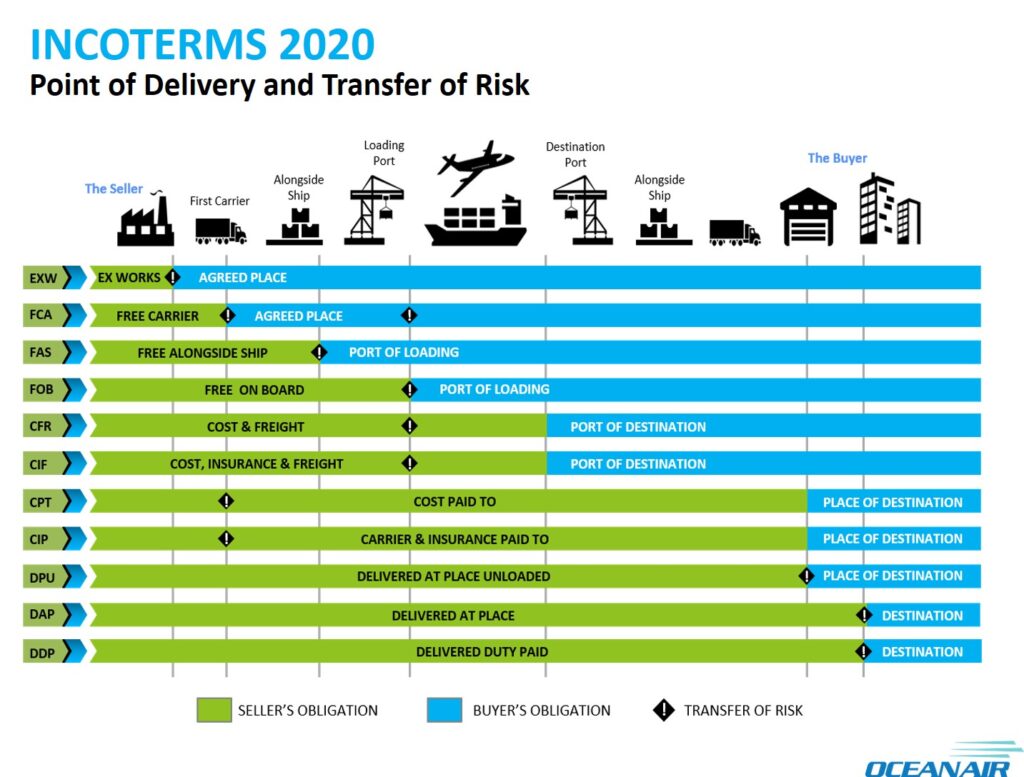

- Always include clear payment terms in the sales contract (Incoterms, payment currency, deadlines, penalties).

- Do buyer credit checks and request trade references.

- Use a reputable bank and confirm LCs if you have country/bank risk concerns.

- Consider trade credit insurance to cover non-payment or political risk.

- Use escrow for one-off or online transactions.

- Document every step — invoices, packing lists, bills of lading, inspection certificates — to support claims if needed.

12. Sample Contract Payment Clause (example)

“Payment terms: 30% advance by telegraphic transfer on order confirmation; balance 70% by irrevocable confirmed Letter of Credit at sight issued by buyer’s bank and confirmed by seller’s bank. Partial shipments allowed. Currency: USD.”

Conclusion

Each payment method balances speed, cost and risk differently. Match the method to your trust level with the buyer, size of transaction, market risk and your cash-flow needs. Use bank instruments (LC, guarantees) when you need security; use open account and supply-chain finance to win business when you can manage credit risk through insurance or receivable financing.

Comments

Add new comment