₹10,000 Crore Crop-Loss Relief Package 2025: How to Apply, Fill Form & How Much Amount Farmers Get

Unseasonal rains in Gujarat during 2025 caused massive crop damage across lakhs of hectares. To support affected farmers, the Gujarat Government announced a ₹10,000 crore Crop-Loss / Disaster Relief Package — the largest such assistance in the state’s history. This blog explains eligibility, documents, how much compensation is given, and step-by-step form filling guide.

PM Kisan Samman Nidhi Yojana 2025: Eligibility, Registration, e-KYC & Installment Status Guide

The Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) is one of the flagship schemes of the Government of India, designed to provide financial support to millions of small and marginal farmers. Launched in 2019, the scheme continues in 2025 with updated processes, Aadhaar-based verification, and faster Direct Benefit Transfer (DBT).

How to Update Aadhaar in EPF Account Online and Offline 2025

The Employees' Provident Fund Organisation (EPFO) has made Aadhaar linking mandatory for smooth EPF transactions, including withdrawal, claim settlement, and transfer of funds. If your Aadhaar is not updated in your EPF account, you may face delays in accessing your provident fund. This guide explains how to update Aadhaar in your EPF account both online and offline in 2025.

How to Avail Digital Subsidies Using Aadhaar 2025: Step-by-Step Guide

In 2025, the Indian government continues to promote Direct Benefit Transfer (DBT) through Aadhaar-enabled services. This system ensures that subsidies for LPG, fertilizers, scholarships, pensions, and farming schemes reach beneficiaries directly without middlemen. Linking Aadhaar with your bank account and subsidy schemes is essential for seamless access.

How to Apply for PM Kisan Scheme Using Aadhaar 2025

The PM Kisan Samman Nidhi Scheme is a government initiative that provides financial assistance to small and marginal farmers across India. In 2025, Aadhaar-based registration has made the application process easier and more secure. This guide explains how to apply, check eligibility, and track your applicati

Aadhaar and Income Tax: Linking PAN and Filing ITR in 2025

In 2025, linking your Aadhaar card with PAN is mandatory for filing Income Tax Returns (ITR) in India. Aadhaar-PAN linking ensures seamless verification, reduces tax fraud, and speeds up the ITR filing process.

Aadhaar Card Linking with LPG, EPF, and Insurance Policies 2025: Complete Guide

In 2025, linking your Aadhaar card with LPG connections, EPF accounts, and insurance policies has become essential to avail government benefits, subsidies, and seamless service. This ensures accurate identification, timely subsidy transfers, and compliance with government regulations.

Aadhaar Card and Mobile Number Linking 2025: Complete Step-by-Step Guide

Linking your Aadhaar card with your mobile number has become mandatory in India as per TRAI and UIDAI guidelines. Mobile number linking ensures proper KYC verification for telecom services, prevents fraudulent usage, and helps you avail government services seamlessly.

How to Link Aadhaar with Bank Account Online and Offline in 2025: Step-by-Step Guide

The Government of India has made it mandatory for citizens to link their Aadhaar card with their bank accounts to enjoy seamless financial services such as receiving subsidies, government benefits, and faster verification. In 2025, most banks allow both online and offline methods for Aadhaar linking, making the process simple and convenient.

Aadhaar Card for NRIs: How to Apply, Update, and Link in India 2025

Non-Resident Indians (NRIs) may need an Aadhaar card in India for financial transactions, filing taxes, or linking with PAN. In 2025, NRIs can apply, update, and link Aadhaar with government services following specific guidelines. This guide explains the complete process.

Aadhaar vs PAN: Why Linking is Mandatory and How to Do It in 2025

In 2025, linking your Aadhaar with PAN is mandatory for all taxpayers in India. The Income Tax Department requires this linkage to ensure accurate tax filing, prevent tax evasion, and simplify verification. This guide explains why linking is necessary and how to do it online safely.

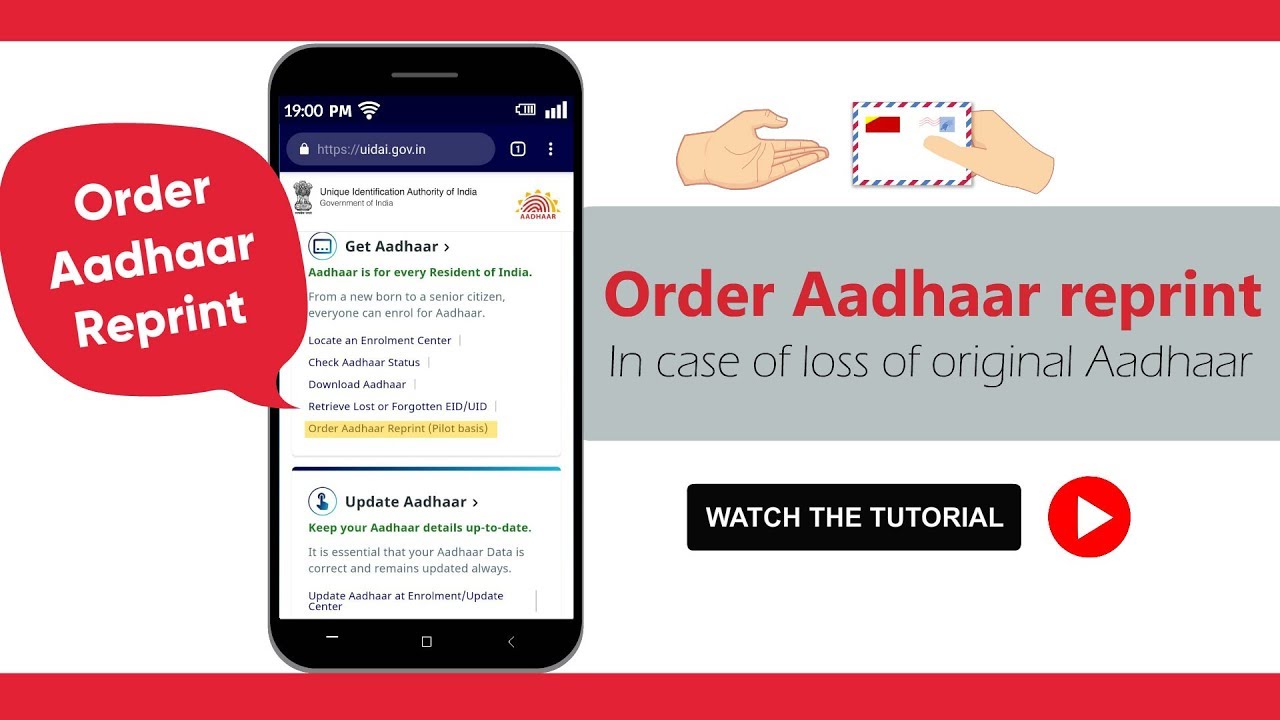

Lost Aadhaar Card? How to Retrieve and Reprint it Online in 2025

Losing your Aadhaar card can be stressful, but in 2025, UIDAI provides a simple and secure way to retrieve and reprint your Aadhaar online. Follow this guide to quickly recover your Aadhaar number and download e-Aadhaar without visiting an enrolment centre.