TDS (Tax Deducted at Source) Explained: Rules, Rates & Latest Changes 2025

Tax Deducted at Source (TDS) is a key part of India’s taxation system. It ensures tax is collected directly from the source of income, preventing evasion and improving compliance. In 2025, several new rules and updates have been introduced that every taxpayer and business must know.

What is TDS?

TDS is a system under the Income Tax Act, 1961, where the payer deducts a certain percentage of tax before making payments like salary, rent, interest, or professional fees. The deducted amount is deposited with the government. The receiver (payee) can claim credit for this deduction while filing their Income Tax Return (ITR).

Latest TDS Rules in 2025

- PAN-Aadhaar linking is mandatory; higher TDS applies if not linked.

- More focus on digital payments and online transaction monitoring.

- TDS on online gaming winnings is fixed at 30% under Section 194BA.

- Senior citizens receive certain relaxations on TDS for interest income.

- Updated exemption thresholds in specific payment categories.

TDS Rates in 2025 (Key Sections)

| Nature of Payment | Section | TDS Rate (2025) |

|---|---|---|

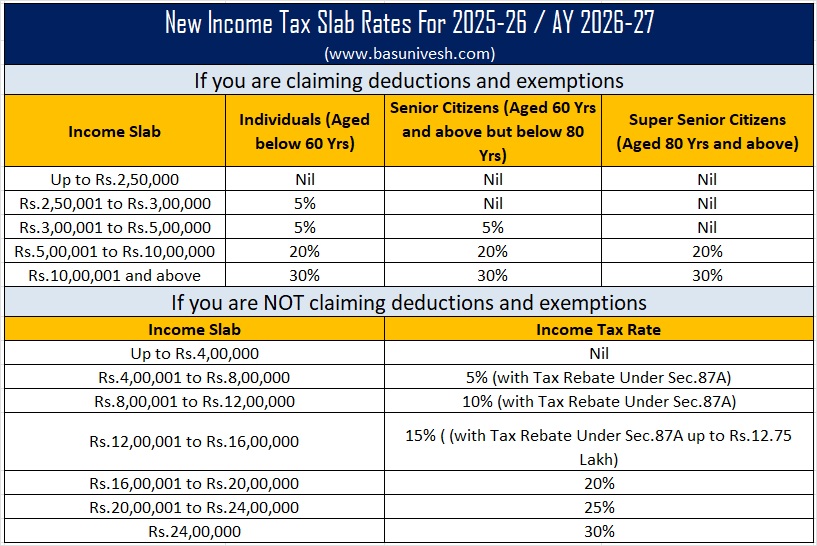

| Salary | 192 | As per Income Tax Slab |

| Interest on Securities | 193 | 10% |

| Dividend | 194 | 10% |

| Rent of Land/Building | 194I | 10% |

| Rent of Plant/Machinery | 194I | 2% |

| Professional Fees | 194J | 10% |

| Contractor Payments | 194C | 1% (individual/HUF), 2% (others) |

| Online Gaming Winnings | 194BA | 30% |

| Purchase of Property | 194IA | 1% (if property value exceeds ₹50 lakh) |

TDS Return Filing in 2025

TDS must be deposited by the 7th of the following month. Quarterly returns are filed through Form 24Q, 26Q, 27Q, or 27EQ. Deductees receive Form 16/16A as proof of tax deducted.

Latest Changes in 2025

- Stricter penalties for late TDS return filing.

- Automated reconciliation with Form 26AS and AIS.

- 1% TDS on cryptocurrency and digital asset transfers continues (Section 194S).

- More emphasis on compliance through e-filing portals.

Conclusion

TDS ensures smooth and transparent tax collection. In 2025, with stricter rules on digital payments, online gaming, and crypto transactions, both individuals and businesses must stay updated to avoid penalties and remain compliant.

Comments

Add new comment