Old vs New Tax Regime 2025: Which One Should You Choose?

With the government continuing to promote the new tax regime in 2025 as the default option, taxpayers are left with an important question – Old vs New Tax Regime: Which one is better? In this guide, we break down the differences, tax slab rates, deductions, and benefits so you can make an informed choice for FY 2025–26.

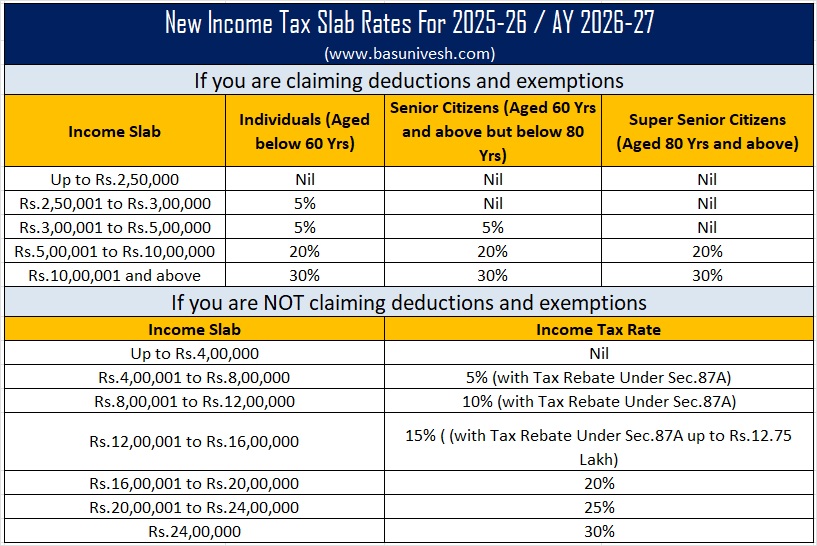

1. Tax Slabs in Old vs New Tax Regime (FY 2025–26)

| Income Range (₹) | Old Regime | New Regime (Default) |

|---|---|---|

| 0 – 2,50,000 | Nil | Nil (0 – 3,00,000) |

| 2,50,001 – 5,00,000 | 5% | 5% (3L – 6L) |

| 5,00,001 – 10,00,000 | 20% | 10% (6L – 9L), 15% (9L – 12L) |

| Above 10,00,000 | 30% | 20% (12L – 15L), 30% (Above 15L) |

2. Key Features of the Old Tax Regime

- Higher tax rates but with deductions and exemptions.

- Popular with individuals investing in PPF, ELSS, LIC, housing loans, etc.

- Allows deductions under Sections 80C, 80D, HRA, LTA, home loan interest, etc.

- Best suited for taxpayers who claim multiple exemptions and deductions.

3. Key Features of the New Tax Regime

- Lower tax rates with no major exemptions.

- Simplified tax structure and compliance.

- Standard Deduction of ₹50,000 available for salaried taxpayers.

- Rebate under Section 87A ensures zero tax liability if income ≤ ₹7 lakh.

- Best suited for individuals with fewer investments and deductions.

4. Old vs New Tax Regime: Which is Better in 2025?

The decision depends on your income level, exemptions, and investment pattern.

- If you maximize deductions under 80C, 80D, HRA, home loan – the Old Regime may be beneficial.

- If you do not claim many deductions, the New Regime with lower rates and simpler filing is better.

5. Example Calculation (₹12,00,000 Income)

Old Regime: After deductions (say 2L under 80C, 80D, home loan), taxable = ₹10,00,000 → Tax = ₹1,12,500 approx.

New Regime: Tax = Around ₹1,05,000 (with no exemptions). Depending on deductions, either regime can be cheaper.

Conclusion

The government is clearly moving toward the new tax regime as the future of income tax in India. However, for 2025, taxpayers still have the choice. Evaluate your deductions, exemptions, and income level before deciding which regime to choose.

Comments

Add new comment