How to File Income Tax for Senior Citizens in 2025

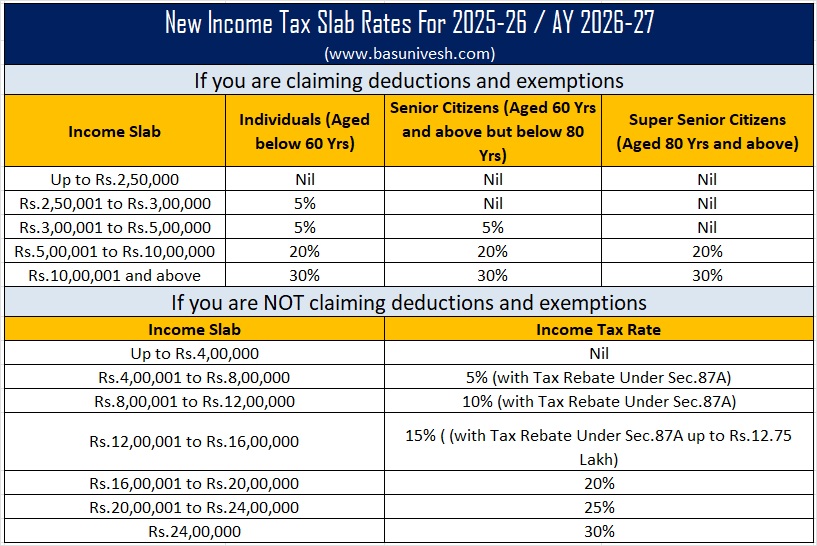

Senior citizens (60 years and above) enjoy higher exemption limits and special deductions while filing income tax in India. This guide explains, step by step, how senior and super senior citizens can file their Income Tax Returns (ITR) for the Assessment Year 2025–26 (FY 2024–25).

1. Who is a Senior or Super Senior Citizen?

- Senior Citizen: Age 60 years or above but less than 80 years.

- Super Senior Citizen: Age 80 years or above.

Both categories have higher basic exemption limits compared to other taxpayers. Residents aged 75+ may be exempt from filing ITR under Section 194P, provided pension and bank interest are their only income sources and tax has been deducted at source by the bank.

2. Do You Need to File ITR?

Filing is mandatory if your gross total income (before deductions) exceeds the basic exemption limit for your age group. Even if not mandatory, filing is recommended to claim refunds or keep records clean.

3. Documents Checklist

- PAN and Aadhaar (linked)

- Form 16 (pension/salary)

- Pension slips or pension certificates

- Bank interest/FD certificates, Form 16A

- Form 26AS / AIS for TDS details

- Investment proofs for 80C, 80D, 80TTB, etc.

- Home loan interest certificate (if applicable)

- Capital gains statements

- Bank account details for refunds

4. Deductions and Benefits for Senior Citizens

- Standard Deduction: Available for pensioners.

- Section 80D: Higher deduction for health insurance premiums.

- Section 80TTB: Deduction up to ₹50,000 on interest income from bank/post office deposits.

- 80C and Section 24(b): Usual deductions for investments and home loan interest.

5. Which ITR Form Should You Use?

- ITR-1 (Sahaj): For income from salary/pension, one house property, and interest income, with no capital gains.

- ITR-2: If you have capital gains, multiple properties, or income not covered in ITR-1.

6. Step-by-Step Filing Process

- Log in to incometax.gov.in with your PAN and password.

- Go to e-File → Income Tax Return → File ITR.

- Select Assessment Year 2025–26 and the correct form (ITR-1 or ITR-2).

- Verify pre-filled details (pension, bank interest, TDS from Form 26AS).

- Enter additional income and deductions manually if needed.

- Review tax computation. If tax is payable, pay via Challan ITNS-280.

- Submit your return and e-verify it online.

7. E-Verification Methods

- Aadhaar OTP

- Net-banking login

- EVC through bank account/ATM

- Physical ITR-V submission to CPC, Bengaluru (if e-verification not possible)

8. Important Due Dates

| Type of Filing | Due Date for FY 2024-25 (AY 2025-26) |

|---|---|

| Regular ITR filing | September 2025 (extended date announced by CBDT) |

| Belated Return | Until belated return window (with penalty) |

9. Common Mistakes to Avoid

- Not reconciling Form 26AS and AIS with your ITR.

- Forgetting to claim Section 80TTB deduction on deposit interest.

- Using the wrong ITR form (e.g., ITR-1 when capital gains exist).

- Not e-verifying after submission.

Conclusion

Filing income tax as a senior citizen in 2025 is easier with digital pre-filled ITR forms and simplified rules. By gathering the right documents, claiming senior-specific deductions, and following the step-by-step process, you can file accurately and avoid penalties.

Comments

Add new comment