Step-by-Step Guide to Filing Income Tax Returns (ITR) Online in 2025

Filing your Income Tax Return (ITR) online has become easier than ever in 2025, thanks to digital initiatives by the Income Tax Department. The process is completely online via incometax.gov.in, making compliance simpler for salaried individuals, freelancers, businesses, and NRIs. In this guide, we provide a step-by-step process to file ITR online in 2025 along with the latest updates and requirements.

1. Who Needs to File ITR in 2025?

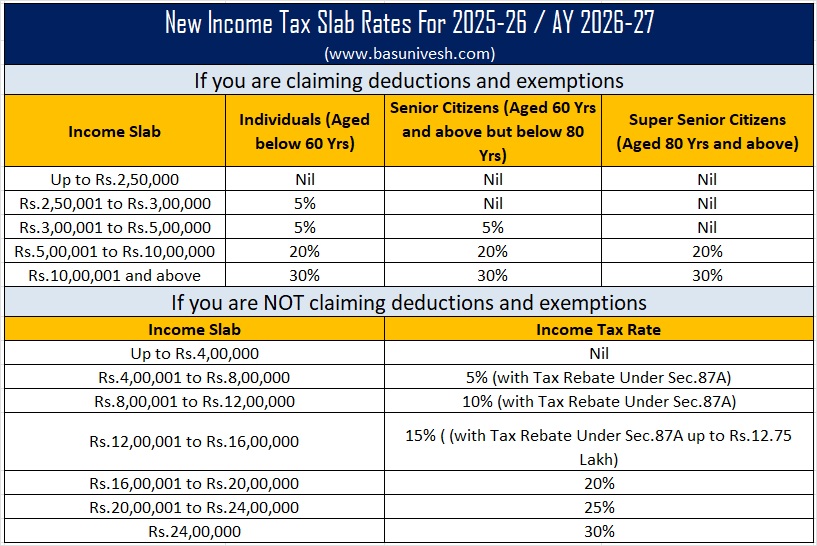

- Individuals earning above the basic exemption limit (₹2.5 lakh under old regime, ₹3 lakh under new regime).

- Businesses, professionals, and freelancers with taxable income.

- NRIs earning taxable income in India.

- Taxpayers claiming refunds or carrying forward losses.

2. Documents Required for ITR Filing

- PAN Card and Aadhaar Card

- Form 16 (for salaried employees)

- Form 26AS and AIS/TIS (Annual Information Statement)

- Bank account details

- Investment proofs (80C, 80D, home loan interest, etc.)

- Capital gains statements (if applicable)

3. Step-by-Step Process to File ITR Online (2025)

- Visit the Income Tax Portal: Go to incometax.gov.in and log in with your PAN/Aadhaar and password.

- Choose e-File → Income Tax Return: Select "File Income Tax Return" under the e-file tab.

- Select the Assessment Year: Choose AY 2025–26 for FY 2024–25 income.

- Choose Filing Type: Individual, HUF, or Company.

- Select the ITR Form: Based on your income sources (see table below).

- Pre-filled Data: Verify pre-filled details like salary, TDS, bank interest from AIS/TIS.

- Enter Additional Income: Report rental income, capital gains, or foreign income.

- Claim Deductions: Add exemptions/deductions (80C, 80D, NPS, HRA, etc.).

- Tax Computation: The system calculates total tax liability or refund.

- Preview & Submit: Review all details carefully and submit.

- e-Verify ITR: Complete verification via Aadhaar OTP, net banking, or digital signature.

4. Comparison of ITR Forms (2025)

| ITR Form | Eligible Taxpayers | Income Sources Covered |

|---|---|---|

| ITR-1 (Sahaj) | Resident Individuals (Income ≤ ₹50 lakh) | Salary, 1 house property, other sources (interest) |

| ITR-2 | Individuals & HUFs (not having business/profession income) | Salary, multiple house properties, capital gains, foreign income/assets |

| ITR-3 | Individuals & HUFs with business/profession income | Salary, house property, capital gains, business/profession |

| ITR-4 (Sugam) | Individuals, HUFs, firms (Presumptive scheme) | Business/profession under Sections 44AD, 44ADA, 44AE |

| ITR-5 | Firms, LLPs, AOPs, BOIs | All income except for ITR-7 category |

| ITR-6 | Companies (except those claiming exemption under Section 11) | Business/profession, capital gains, etc. |

| ITR-7 | Trusts, political parties, research institutions, charitable organizations | Income claimed under Sections 139(4A), 139(4B), 139(4C), 139(4D) |

5. Latest Updates in ITR Filing 2025

- New pre-filled ITR forms with AIS/TIS integration.

- More taxpayers defaulted to the New Tax Regime.

- Enhanced e-verification options including DigiLocker integration.

- AI-based error checks to avoid mismatches.

6. Common Mistakes to Avoid

- Not reconciling Form 26AS and AIS with your income.

- Choosing the wrong ITR form.

- Failing to e-verify within 30 days.

- Not reporting foreign assets or crypto transactions.

Conclusion

Filing your ITR online in 2025 is seamless if you follow the right steps and select the correct ITR form. Always verify your income details, reconcile with AIS/TIS, and file before the deadline to avoid penalties. Choosing the right ITR form ensures hassle-free processing and quicker refunds.

Comments

Add new comment