Non-Resident Indians (NRIs) have unique tax obligations in India. Understanding NRI income tax rules, exemptions, and filing requirements is crucial to stay compliant in 2025. This guide covers residential status, taxable income, deductions, and filing procedures for NRIs.

1. Who is Considered an NRI?

- Stayed in India for less than 182 days in the financial year, or

- Stayed for less than 60 days in the year and less than 365 days in the preceding four years.

2. Taxable Income for NRIs in 2025

| Income Type | Taxability |

|---|

| Salary in India | Fully taxable |

| Rental Income from property in India | Fully taxable |

| Capital Gains (Property, Stocks) | STCG or LTCG rules apply |

| Interest from Indian bank accounts | Taxable (TDS may apply) |

| Dividends from Indian companies | Taxable @ 10% (TDS deducted) |

3. Exemptions and Deductions Available for NRIs

- Section 80C: LIC, ELSS, investments (if eligible)

- Section 80D: Health insurance premiums in India

- Capital gains exemptions under Section 54, 54EC, 54F

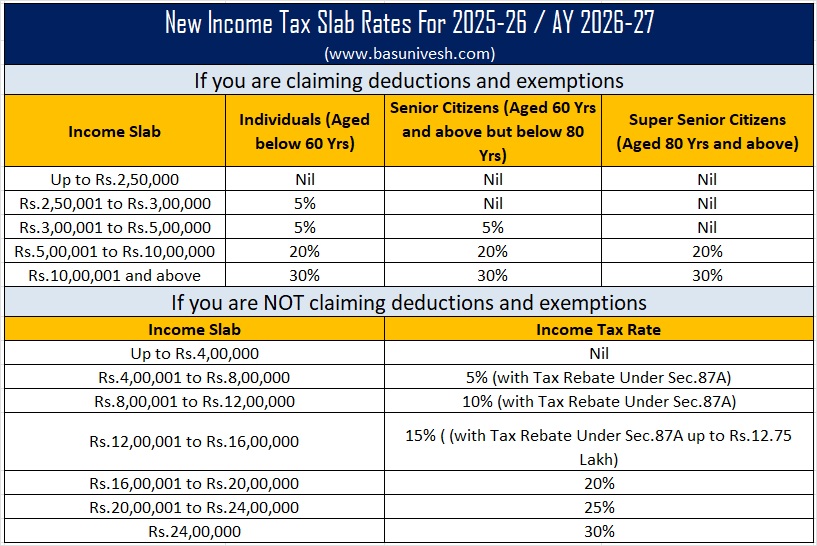

4. NRI Income Tax Rates 2025

| Income Slab (₹) | Tax Rate (Individual) |

|---|

| Up to 2,50,000 | Nil |

| 2,50,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

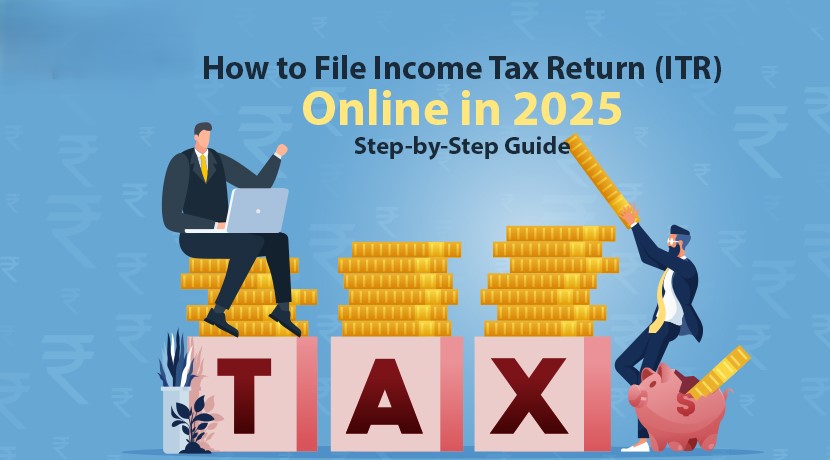

5. Filing Tax Returns for NRIs

- Use ITR-2 or ITR-3 depending on income type

- Mandatory if total income in India exceeds ₹2,50,000

- Claim refunds if TDS exceeds tax liability

6. NRI Tax Filing Checklist (2025)

| Income Type | Form | Due Date | TDS Rate | Exemption / Notes |

|---|

| Salary in India | ITR-2 | 31st July 2025 | 10-30% | Eligible for deductions under 80C/80D |

| Rental Income | ITR-2 | 31st July 2025 | 30% | Standard deduction 30% available |

| Capital Gains (Property, Stocks) | ITR-2 | 31st July 2025 | STCG: 15% / LTCG: 10-20% | Exemptions under Section 54, 54EC, 54F |

| Interest Income (NRO / Bank) | ITR-2 | 31st July 2025 | 30% | Interest from NRE accounts is tax-free |

| Dividends from Indian Companies | ITR-2 | 31st July 2025 | 10% | TDS deducted at source, claimable if excess |

7. Tax Planning Tips for NRIs

- Invest in NRI-eligible tax-saving instruments

- Maintain records of rent, property sale, and capital gains

- Utilize DTAA (Double Taxation Avoidance Agreement) if applicable

- Choose NRO vs NRE accounts wisely based on taxability

Conclusion

NRIs must understand taxable income, exemptions, deductions, and filing procedures to remain compliant in 2025. The checklist makes filing easy and ensures no income type is missed. Proper planning ensures legal tax optimization and avoids penalties.

Comments

Add new comment