Section 87A Rebate: Eligibility and Tax Savings in 2025

Section 87A of the Income Tax Act provides a tax rebate for resident individuals with income below a specified threshold. Understanding eligibility, rebate amount, and tax-saving potential is crucial for taxpayers in 2025.

1. What is Section 87A Rebate?

- Offers a rebate on income tax to resident individuals.

- Reduces the tax liability but does not exceed the maximum limit.

2. Eligibility Criteria in 2025

- Must be a resident individual (NRIs not eligible).

- Total taxable income ≤ ₹5,00,000 after deductions under 80C, 80D, etc.

3. Rebate Amount

| Financial Year | Maximum Rebate | Notes |

|---|---|---|

| FY 2024-25 | ₹12,500 | Applicable if taxable income ≤ ₹5,00,000 |

| FY 2025-26 | ₹12,500 | Updated threshold as per latest rules |

Note: If tax payable is less than ₹12,500, rebate is limited to actual tax liability.

4. How to Claim Section 87A Rebate

- Calculate gross total income.

- Apply deductions under Chapter VI-A (80C, 80D, etc.).

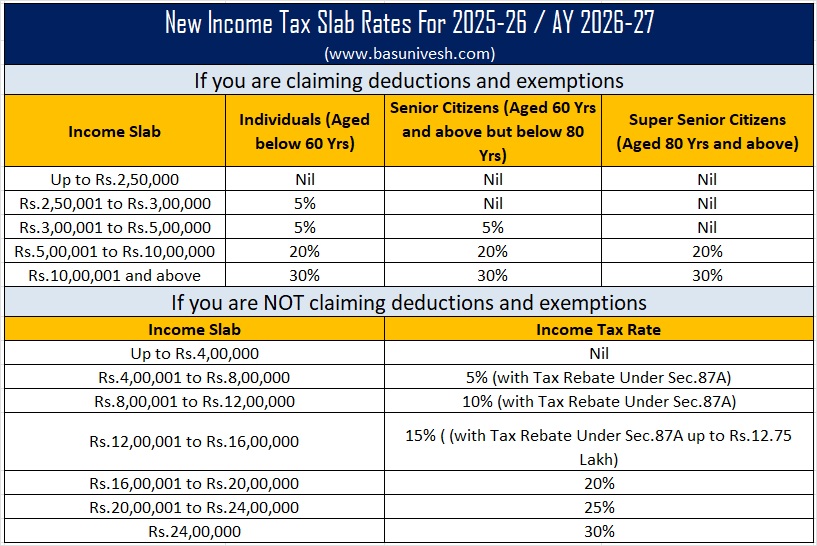

- Calculate tax on net taxable income using applicable slab.

- Rebate under Section 87A is automatically applied when filing ITR.

5. Practical Example

| Scenario | Taxable Income | Tax Before Rebate | Tax After 87A Rebate |

|---|---|---|---|

| Individual with ₹4,50,000 income | ₹4,50,000 | ₹22,500 | ₹10,000 |

| Individual with ₹5,00,000 income | ₹5,00,000 | ₹25,000 | ₹12,500 |

| Individual with ₹5,50,000 income | ₹5,50,000 | ₹32,500 | ₹32,500 (Not eligible) |

6. Tax Planning Tips

- Claim eligible deductions under 80C, 80D, 80E to reduce taxable income below ₹5,00,000.

- Utilize Section 87A to maximize tax savings for low-income earners.

- File ITR on time to ensure automatic rebate application.

Comments

Add new comment