Complete Guide to Income Tax Deductions and Exemptions in 2025

This guide explains the most important deductions and exemptions available to taxpayers in India in 2025 (FY 2024–25 / AY 2025–26), how to claim them step-by-step, required documents, and common pitfalls to avoid.

Quick orientation

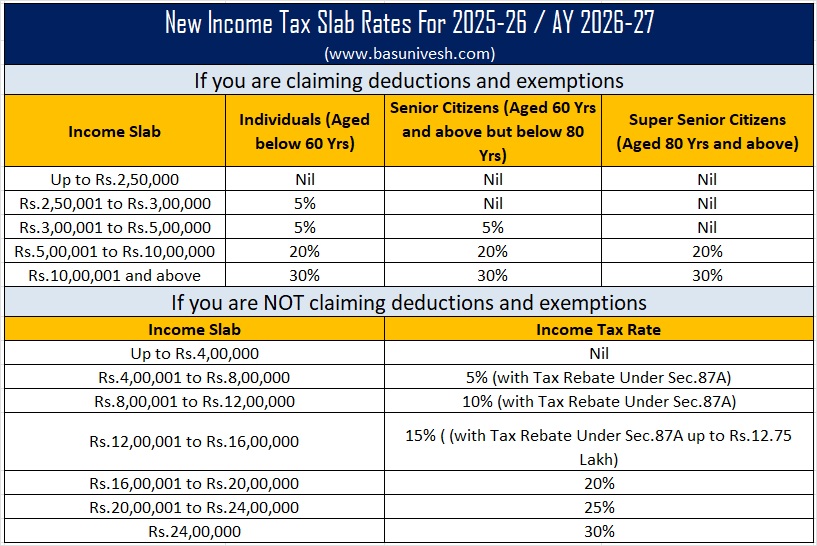

- Old vs New tax regime: Many popular deductions (eg. most Section 80 benefits) are available under the old regime. The new regime offers lower slab rates but fewer deductions — check both before you file.

- Standard deduction & rebate changes (2025): there were key changes in 2025 (standard deduction availability and rebate thresholds) — confirm items below when planning. (See sources at the end.)

STEP 1 — Decide your tax regime (Old vs New)

- List your expected deductions for the year (80C, 80D, home loan interest, HRA, etc.).

- Compute approximate tax under both regimes (taxable income after deductions vs new-regime slabs).

- Choose the regime that gives lower tax for your situation — you can switch each year subject to rules. If unsure, run quick comparisons with a calculator or ask your tax advisor.

STEP 2 — Know the cornerstone, standard deduction & rebate

Standard deduction: salaried taxpayers get a standard deduction (check current amount and whether the new regime allows it). Also check the Section 87A rebate thresholds for the year you’re filing — these change with the Budget. (Official FAQ and Budget doc confirm the 2025 changes listed in sources.)

STEP 3 — Table: Key Deductions & Exemptions (what, limit, notes, docs)

| Section | What it covers | Limit (typical / FY 2024-25) | Notes & Documents |

|---|---|---|---|

| Section 80C | PPF, ELSS, EPF, life insurance premiums, principal repayment of home loan, SSY, NSC, tuition fees | Up to ₹1,50,000 total per year. :contentReference[oaicite:0]{index=0} | Provide investment receipts, policy/account numbers, PPF passbook screenshots, mutual fund statements. |

| Section 80CCD(1B) | Additional self-contribution to NPS (Tier I) | Up to ₹50,000 (over & above 80C limit). :contentReference[oaicite:1]{index=1} | Use NPS contribution statement; quote PRAN/account number. |

| Section 80D | Health insurance premium / preventive health check-up | Up to ₹25,000 for self & family; higher limits apply for senior citizens (check current limits). :contentReference[oaicite:2]{index=2} | Insurance premium receipt, policy number, GST invoice for premium. |

| Section 24(b) | Interest on home loan (Income from house property) | Up to ₹2,00,000 for self-occupied property (old regime / where applicable). :contentReference[oaicite:3]{index=3} | Loan interest certificate from lender, principal & interest breakup. |

| House Rent Allowance (HRA) — Sec 10(13A) | Exemption for rent paid (if you receive HRA) | Exemption = least of (a) HRA received; (b) rent paid − 10% of salary; (c) 50% of salary (metro) or 40% (non-metro). :contentReference[oaicite:4]{index=4} | Rent receipts / lease agreement, landlord PAN (if rent >₹1L/yr), Form 12BB details to employer. |

| Section 80E | Interest on education loan | No upper monetary limit; allowable for loan tenure (specified years) | Loan account statement, interest certificate from lender. |

| Section 80G | Donations to eligible charities | Varies — some donations 50% or 100% of donation with/without restriction | Donation receipt with PAN of donee, registration/80G certificate. |

| Section 80TTA / 80TTB | Interest on savings bank deposits / interest on deposits for seniors | 80TTA: up to ₹10,000 (non-senior); 80TTB: up to ₹50,000 (senior citizens). :contentReference[oaicite:5]{index=5} | Bank interest statement (Form 16A / bank statement). |

| Gratuity / Leave Encashment / PF | Certain service-related receipts are exempt up to statutory limits | Limits vary by rules (gratuity ceiling, PF exemption rules) | Service record, employer certificate, PF statement. |

Notes: some deductions (eg. most 80C items, 24(b) home loan interest) are typically claimed under the old regime. The new regime in 2025 includes some changes — check the Budget/Income Tax FAQ to see which deductions remain available (key official FAQ listed below).

STEP 4 — Step-by-step: How to claim these deductions (practical)

- Start early: compile receipts / account numbers through the year (mutual fund folios, PPF passbook, premium receipts).

- Tell your employer (Form 12BB): submit proof of investments and HRA/rent details so TDS is deducted correctly during the year (reduces TDS and improves cashflow). Employers usually require these proofs annually.

- Collect lender/insurer certificates: lender interest certificates, insurance premium receipts, NPS contribution slips, donation receipts with registration numbers.

- Enter details in ITR: use the ITR utility (income tax e-filing) to fill schedules for deductions — schedule-wise fields exist (eg. Schedule VIA for certain deductions; house property schedule for 24(b)).

- Attach supporting info when requested: the new ITR utility may ask for policy/folio numbers, landlord details, etc. Save scanned copies.

- Submit & e-verify: file, e-verify via Aadhaar OTP / netbanking / DSC to complete filing.

STEP 5 — Documentation checklist (what to keep)

- Investment receipts & account numbers (PPF, ELSS, PPF passbook pages)

- Life insurance premium receipts, policy numbers

- Health insurance premium receipts, policy number & insurer name

- Loan interest certificate & principal repayment schedule from bank

- Rent receipts / lease agreement / landlord PAN (if required)

- Donation receipts with registration number for 80G

- Form 16, Form 26AS / AIS (Annual Information Statement)

STEP 6 — Common mistakes & how to avoid them

- Claiming a deduction without supporting documents — keep originals and scanned copies.

- Double-counting the same investment across sections (e.g., both 80C and elsewhere).

- Not submitting Form 12BB to employer — leads to higher TDS.

- Ignoring special-rate incomes (STCG/LTCG) that may not be eligible for certain rebates — understand exclusions.

STEP 7 — Small employer / freelancer tips

- Self-employed: claim deductions while filing ITR (there’s no Form 12BB route for reducing TDS).

- Freelancers/contractors: maintain invoices and bank transaction proofs to tie income & expenses.

Useful examples (how to think about deduction stacking)

- Max out 80C (₹1.5L) first if you have long-term commitments (PPF/ELSS/EPF/principal repayment).

- Top up NPS under 80CCD(1B) for an extra ₹50k benefit (if retirement saving is ok for you).

- Buy or maintain adequate family health cover to utilize 80D limits (helps both protection and tax).

- If you pay rent, estimate HRA exemption — sometimes it saves more than investing in 80C instruments.

FAQ — short answers

- Can I claim 80C + 80CCD(1B)? Yes — 80C aggregate limit is ₹1.5L, plus 80CCD(1B) allows an additional ₹50k (NPS), subject to rules. :contentReference[oaicite:6]{index=6}

- Is health insurance premium deductible? Yes — within limits (80D). Keep premium receipts and policy numbers. :contentReference[oaicite:7]{index=7}

- Is home loan interest deductible? Interest on self-occupied property is generally allowed up to ₹2L under Section 24(b) (subject to rules); check whether you’re filing old or new regime. :contentReference[oaicite:8]{index=8}

- Where do I enter these in ITR? Deductions go into Schedule VIA / specific schedules for house property / other sections when you use the e-filing utility.

Quick checklist before you file:

- Collect receipts and lender/insurer certificates.

- Submit Form 12BB to employer (if salaried).

- Reconcile Form 26AS / AIS with your Form 16 and bank statements.

- File ITR, attach/enter required details, and e-verify within 30 days.

Need-to-know legal / authoritative references

Check the official Income Tax Department FAQ and your Budget notes for authoritative confirmation of slab/rebate and standard deduction changes in 2025 — details and exact numeric thresholds are published by the government each Budget and in the Income Tax Department FAQs (links in sources below).

If you want, I can also:

- Convert this into a one-page downloadable PDF for readers.

- Create a small deduction calculator (HTML + JS) to help readers estimate taxable income after deductions.

Comments

Add new comment