Agricultural Income and Taxation Rules in India 2025

Agriculture continues to be a backbone of the Indian economy, and the government provides special income tax exemptions to support farmers. However, agricultural income is not entirely free from the income tax framework. In 2025, the rules for agricultural income taxation in India remain largely consistent, with certain clarifications and compliance requirements. This blog explains the latest taxation rules, exemptions, and filing procedures for agricultural income in India 2025.

1. What is Agricultural Income?

As per the Income Tax Act, agricultural income refers to income earned through:

- Rent or revenue from agricultural land in India.

- Income from cultivation of crops or harvesting activities.

- Profits from sale of agricultural produce grown by the farmer.

- Farmhouse income (subject to specific conditions).

2. Is Agricultural Income Taxable in India?

Agricultural income in India is exempt from income tax under Section 10(1) of the Income Tax Act. However, if a taxpayer has both agricultural and non-agricultural income, the concept of partial integration applies, which may indirectly increase their tax liability.

3. Partial Integration of Agricultural Income

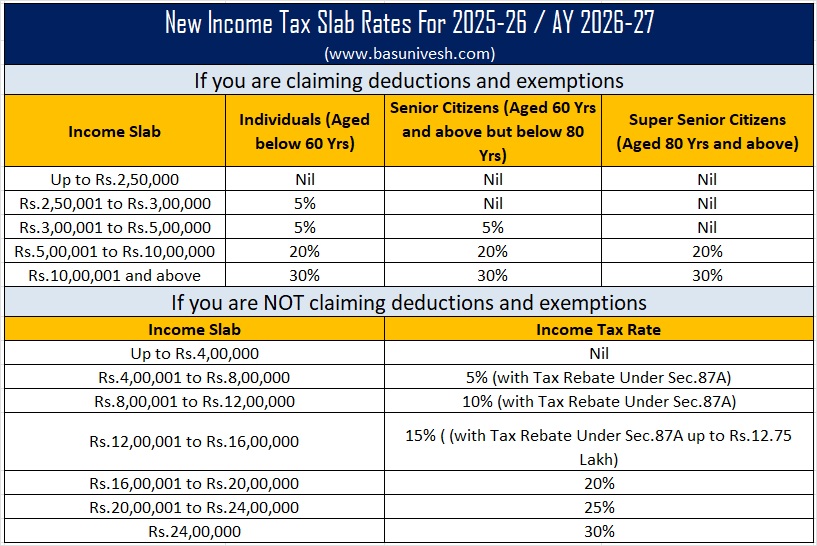

If agricultural income exceeds ₹5,000 in a financial year and non-agricultural income exceeds ₹2,50,000 (basic exemption limit), agricultural income is added for rate purposes only.

Example Calculation:

| Particulars | Amount (₹) |

|---|---|

| Agricultural Income | 4,00,000 |

| Non-Agricultural Income | 8,00,000 |

| Total Income Considered for Tax Rate | 12,00,000 |

| Tax Calculated on 12,00,000 – 4,00,000 | Based on applicable slab |

This means agricultural income is not directly taxed, but it influences the tax slab applicable to non-agricultural income.

4. Exemptions Available

- Entire income from cultivation and sale of crops is exempt.

- Income from land rent used for agricultural purposes is exempt.

- Income from farmhouse property is exempt only if it meets prescribed conditions (size, distance from city, etc.).

5. Taxable Agricultural-Linked Income

Certain types of income are not considered agricultural income and are taxable:

- Processing of agricultural products beyond the ordinary process.

- Income from trading agricultural produce (not grown by the taxpayer).

- Income from dairy, poultry, fisheries, or plantations like tea, coffee, and rubber (partially taxable).

6. Filing ITR with Agricultural Income

Farmers or taxpayers with agricultural income must disclose it while filing Income Tax Returns (ITR), especially when claiming exemption under Section 10(1). Agricultural income is to be reported in:

- ITR-1 if agricultural income ≤ ₹5,000.

- ITR-2 if agricultural income > ₹5,000.

7. Key Compliance Tips for 2025

- Maintain proper documentation of crop sales and land ownership.

- Declare agricultural income in ITR even if it is fully exempt.

- If you earn both agricultural and non-agricultural income, compute tax carefully under partial integration rules.

- Seek professional advice if income comes from plantations or farmhouse property.

Conclusion

Agricultural income remains tax-free in India in 2025, but it plays an important role in determining tax rates when combined with non-agricultural income. Farmers and taxpayers should ensure correct reporting to avoid scrutiny and penalties. By understanding agricultural income taxation rules in India 2025, you can make informed decisions and plan your taxes effectively.

Comments

Add new comment