Income Tax Slabs in India 2025: Latest Updates and Comparison with 2024

The Indian government announces Income Tax Slabs every year during the Union Budget. For FY 2025–26, the government has retained the focus on the new simplified tax regime, while still allowing taxpayers to opt for the old regime with exemptions. In this article, we cover the latest Income Tax Slabs in India 2025 and compare them with the 2024 slabs to help individuals and businesses plan their taxes better.

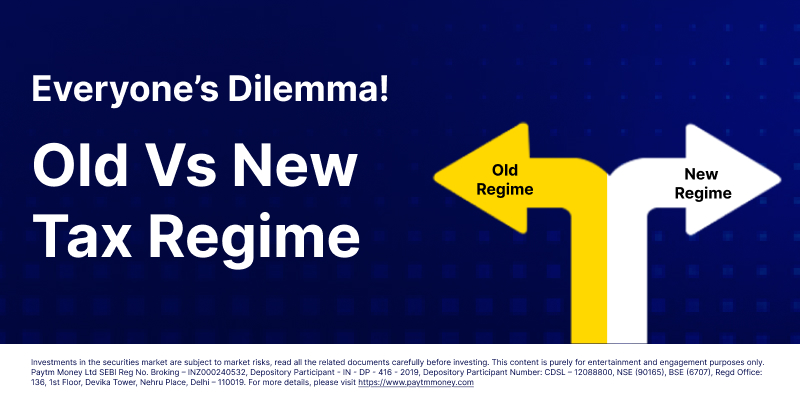

1. Income Tax Regimes in India

In 2025, taxpayers in India can choose between:

- Old Regime: Higher tax rates but with exemptions/deductions like HRA, LTA, 80C, 80D, etc.

- New Regime: Lower tax rates with no major exemptions, but simpler compliance.

2. Income Tax Slabs for FY 2025–26 (New Regime – Default)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5% |

| 6,00,001 – 9,00,000 | 10% |

| 9,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| Above 15,00,000 | 30% |

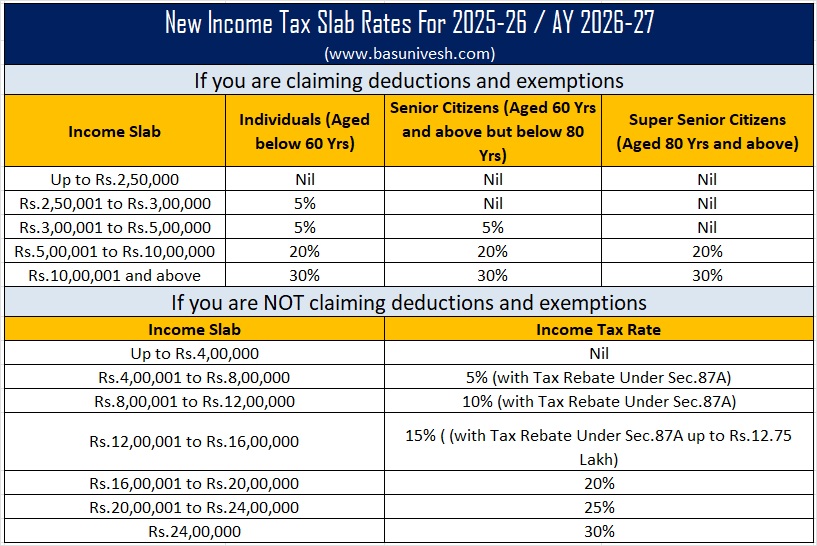

3. Income Tax Slabs for FY 2025–26 (Old Regime)

| Category | Income Range (₹) | Tax Rate |

|---|---|---|

| Individuals (Below 60) | 0 – 2,50,000 | Nil |

| All Individuals | 2,50,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% | |

| Above 10,00,000 | 30% | |

4. Comparison of Income Tax Slabs: 2024 vs 2025

| Regime | FY 2024–25 | FY 2025–26 |

|---|---|---|

| New Regime (Default) | 0 – 3L: Nil, 3L–6L: 5%, 6L–9L: 10%, 9L–12L: 15%, 12L–15L: 20%, Above 15L: 30% | No major change – Same slab rates continued |

| Old Regime | 0 – 2.5L: Nil, 2.5L–5L: 5%, 5L–10L: 20%, Above 10L: 30% | Unchanged – taxpayers can still opt for this |

5. Key Updates in 2025

- Standard Deduction: ₹50,000 continues for salaried taxpayers under both regimes.

- Rebate under Section 87A: Individuals with income up to ₹7 lakh under new regime pay zero tax.

- Focus on New Regime: Government continues to promote the new tax regime as default.

6. Which Regime Should You Choose?

If you claim significant exemptions (like HRA, 80C investments, insurance, housing loan interest), the old regime may still be beneficial. But for most salaried individuals with fewer deductions, the new regime offers lower taxes and simpler filing.

Conclusion

The Income Tax Slabs in India 2025 remain largely unchanged from 2024, with the government continuing to push the new tax regime as the default option. Taxpayers should evaluate their income, deductions, and exemptions carefully to choose the right regime and minimize their tax liability.

Comments

Add new comment