Advance Tax Payment in India: Due Dates, Calculation & Penalties 2025 Guide

Advance Tax is a system where taxpayers pay their tax liability in installments instead of a lump sum at the end of the financial year. This ensures timely collection of taxes and reduces the burden at the time of filing the Income Tax Return (ITR). In 2025, knowing the due dates, calculation methods, and penalties is essential for compliance.

1. What is Advance Tax?

- Also called “Pay As You Earn” scheme.

- Applicable if tax liability exceeds ₹10,000 in a financial year.

- Paid in installments according to the financial year.

- Covers all income: salary, business, capital gains, freelance income.

2. Who Needs to Pay Advance Tax?

- Salaried individuals with additional income (interest, capital gains).

- Freelancers, professionals, and business owners.

- Individuals and companies liable for self-assessment tax.

3. Advance Tax Due Dates in 2025

| Installment | Due Date | % of Estimated Tax Payable |

|---|---|---|

| 1st | 15th June | 15% |

| 2nd | 15th September | 45% cumulative |

| 3rd | 15th December | 75% cumulative |

| 4th | 15th March | 100% cumulative |

4. How to Calculate Advance Tax

Step 1: Estimate total income for the financial year.

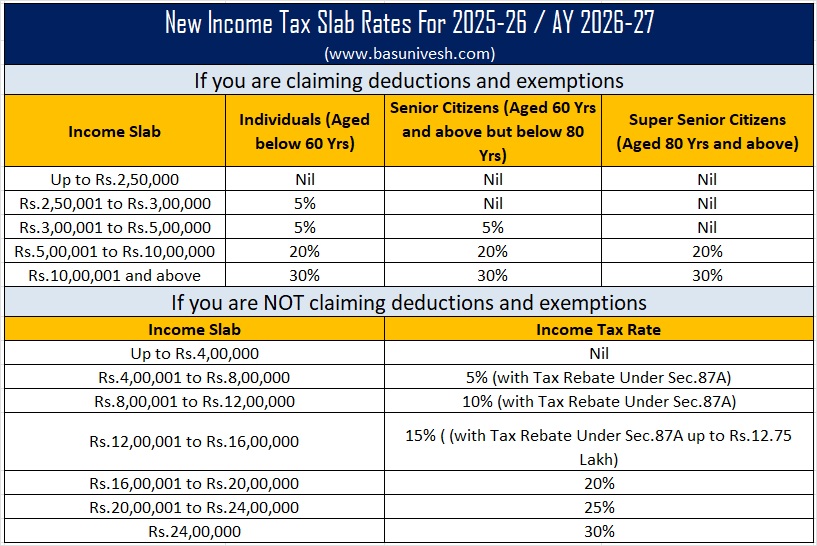

Step 2: Calculate total tax using applicable slabs.

Step 3: Deduct TDS/TCS already collected.

Step 4: Pay remaining as advance tax in installments.

5. Advance Tax Calculation Example (Freelancer & Salaried)

| Type of Taxpayer | Estimated Taxable Income | Total Tax | TDS Deducted | Advance Tax Payable |

|---|---|---|---|---|

| Freelancer | ₹12,00,000 | ₹1,50,000 | ₹30,000 | ₹1,20,000 |

| Salaried Employee | ₹8,00,000 | ₹80,000 | ₹60,000 | ₹20,000 |

| Self-Employed Business | ₹20,00,000 | ₹3,00,000 | ₹50,000 | ₹2,50,000 |

6. Penalties for Late Payment

| Late Payment | Penalty / Interest |

|---|---|

| Missed installment | Interest @ 1% per month (Section 234B/234C) |

| Short payment | Interest on unpaid amount until actual payment |

| Non-payment | Additional penalty under IT Act |

7. How to Pay Advance Tax

- Visit https://www.tin-nsdl.com or your bank portal.

- Fill Challan ITNS 280.

- Provide PAN, Assessment Year, and Type of Tax.

- Payment via net banking, debit card, or cheque.

Conclusion

Advance Tax is crucial for tax planning and avoids last-minute payments and penalties. For salaried employees, freelancers, and business owners, understanding due dates, calculation, and paying on time ensures smooth compliance in 2025.

Comments

Add new comment