Sector-Wise GST Rates in 2025: Everything You Need to Know

-

- by MI September 17, 2025

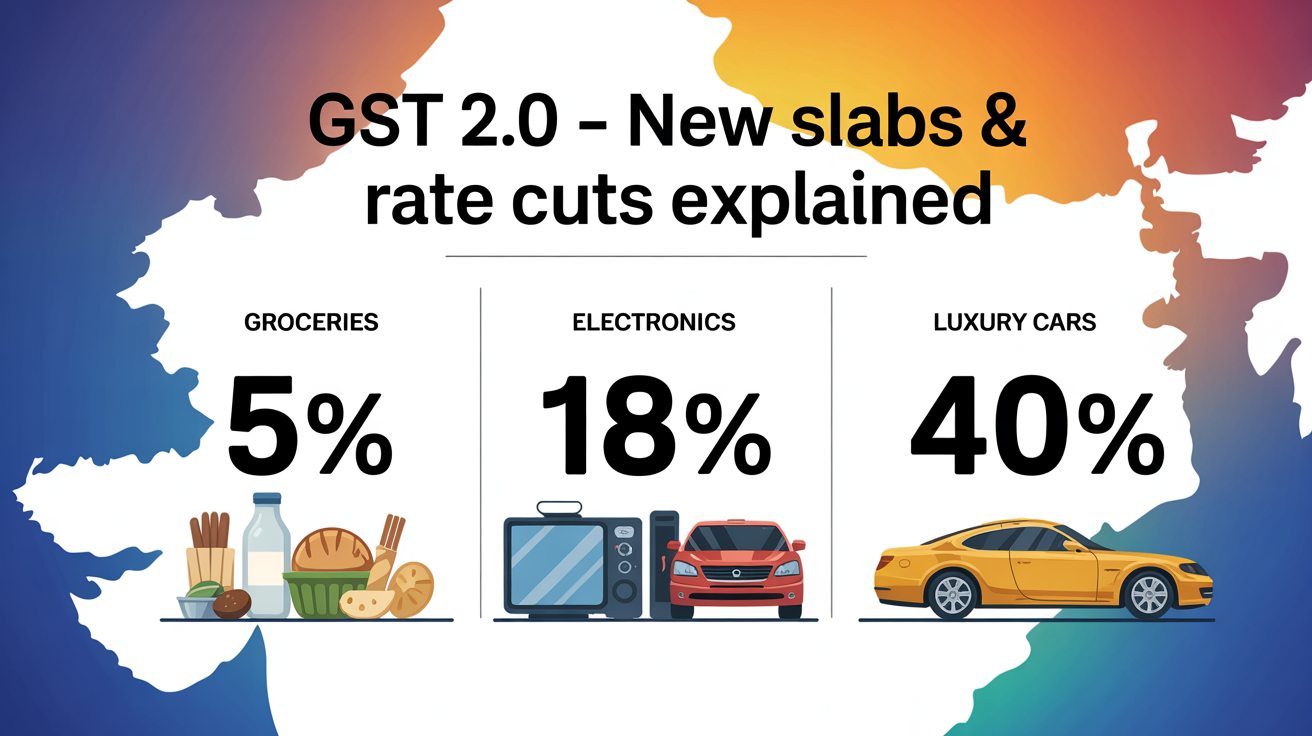

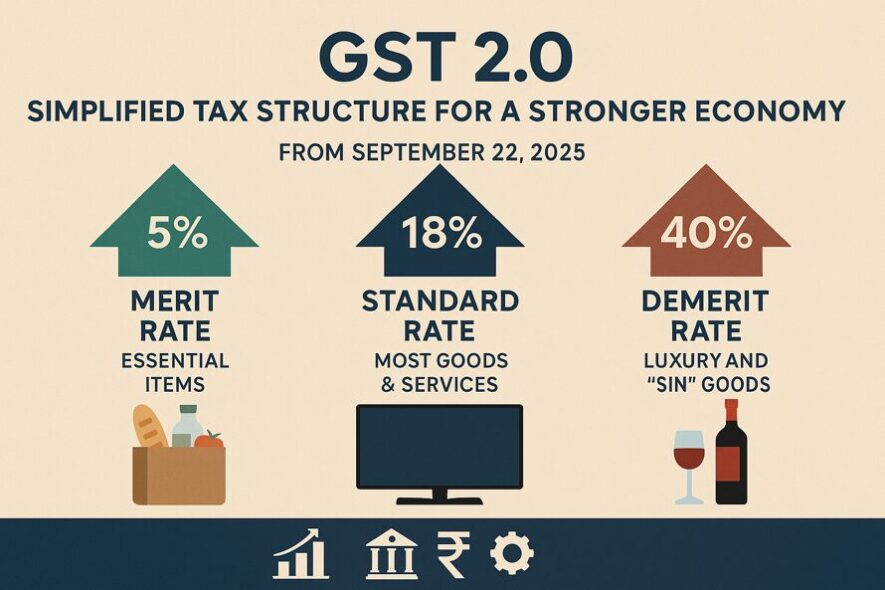

With the implementation of GST 2.0 in 2025, India’s indirect tax system has become more streamlined. Different industries and sectors are subject to different GST rates. This guide provides a comprehensive overview of sector-wise GST rates in 2025, helping businesses and consumers understand applicable taxes.

GST Rates on Goods

| Sector / Goods | GST Rate 2025 | Remarks |

|---|---|---|

| Essential Food Items (e.g., Rice, Wheat, Milk) | 0% | Exempted to reduce burden on consumers |

| Packaged Food & Beverages | 4% | Reduced GST slab under GST 2.0 |

| Consumer Electronics | 10% | Standard GST rate for mid-range goods |

| Luxury Goods (Cars, Tobacco) | 20% | Higher slab for luxury and sin goods |

| Gold & Jewelry | 3%-5% | Depending on type and making charges |

GST Rates on Services

| Service Sector | GST Rate 2025 | Remarks |

|---|---|---|

| Telecom Services | 15% | Standard GST rate for telecom and IT services |

| Hospitality (Hotels, Restaurants) | 12%-18% | Depends on room tariff / service type |

| Financial Services | 18% | Banking and insurance services |

| Education Services | 0% | Exempted under GST 2.0 |

| Healthcare Services | 0% | Exempted for essential healthcare |

Key Highlights of Sector-Wise GST Rates in 2025

- Essential goods and services largely remain exempted (0%)

- Luxury and sin goods attract higher GST rates (20%)

- Services like education and healthcare remain tax-free

- Mid-range goods and standard services are taxed between 10%-15%

- GST 2.0 simplifies slab structure for easier compliance

Conclusion

Understanding sector-wise GST rates in 2025 is essential for businesses to ensure correct tax compliance and pricing. GST 2.0 brings transparency, reduces complexities, and helps both consumers and companies navigate the tax system efficiently. Always check notifications for updates to sector-specific GST rates to stay compliant.

See More Related Blog

Latest GST Rates in India 2025: Complete List for Businesses

-

- by MI

The Goods and Services Tax (GST) is a unified indirect tax system in India that applies to almost all goods and services. In 2025, the GST Council has continued to…

GST on Healthcare Services and Medical Equipment in 2025

-

- by MI

The healthcare sector in India is rapidly evolving, and with GST 2.0 in 2025, it is important for hospitals, clinics, and medical equipment suppliers to understand…

How GST 2.0 Streamlines Tax Refunds for Exporters

-

- by MI

Exports are vital for India’s economic growth, and GST 2.0 in 2025 has brought significant improvements to the tax refund process for exporters. By streamlining…

Future Roadmap of GST in India: Reforms Expected Beyond 2025

-

- by MI

The Goods and Services Tax (GST) has been a cornerstone of India’s indirect tax system since 2017. With GST 2.0 in 2025, significant reforms have already streamlined…

GST on Agricultural Exports: Cotton, Rice, and Spices Explained

-

- by MI

Agriculture has always been the backbone of India’s economy, and agricultural exports like cotton, rice, and spices play a significant role in foreign trade. With GST 2.…

GST on the Entertainment Industry: OTT, Cinema, and Live Events

-

- by MI

The entertainment industry in India has undergone a massive transformation in recent years, with OTT platforms, multiplex cinemas, and live events becoming key…

GST 2.0 and Government Revenue: Boost or Burden?

-

- by MI

Since its introduction in 2017, the Goods and Services Tax (GST) has been one of the most significant tax reforms in India. With the rollout of GST 2.0 in 2025, the…

Understanding GST TDS and TCS Rules in 2025

-

- by MI

The Goods and Services Tax (GST) framework in India not only focuses on tax collection but also ensures transparency through mechanisms like TDS (Tax Deducted at Source…

Difference Between Central Tax and State Tax under GST

-

- by MI

The Goods and Services Tax (GST) in India is divided into two parts – Central Tax and State Tax. This dual tax structure ensures that both the Central Government and…

GST 2.0 and Its Effect on Corporate Tax Planning in India

-

- by MI

With the introduction of GST 2.0 in 2025, corporate tax planning in India has undergone significant changes. Businesses must now rethink their financial strategies, tax…

GST on Petroleum Products: Will It Come Under GST in 2025?

-

- by MI

One of the most debated topics in India’s taxation system is whether petroleum products like petrol, diesel, LPG, and natural gas should be brought under the ambit of…

How GST Shapes Retail Pricing in the Indian Consumer Market in 2025

-

- by MI

The retail sector in India is one of the fastest-growing industries, contributing significantly to GDP and employment. With the implementation of GST (Goods and Services…

Impact of GST 2.0 on India’s EV (Electric Vehicle) Market in 2025

-

- by MI

The electric vehicle (EV) market in India is witnessing rapid growth, driven by government incentives, rising fuel costs, and consumer awareness of sustainable mobility…

GST 2.0 and Ease of Doing Business: Benefits for MSMEs

-

- by MI

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India’s economy, contributing nearly 30% to GDP and employing millions. However, compliance and taxation…

How GST Affects the Indian FMCG Sector: Price and Compliance Changes in 2025

-

- by MI

The Fast-Moving Consumer Goods (FMCG) sector is a critical part of India’s economy, covering products like packaged foods, beverages, personal care items, and household…

GST 2.0 and Ease of Doing Business in India (2025)

-

- by MI

India has made significant progress in improving its ease of doing business, and GST 2.0, implemented in 2025, is a major step in that journey. By simplifying tax filing…

How GST Impacts Online Gaming and Fantasy Sports in India (2025)

-

- by MI

The online gaming industry in India has grown rapidly, especially in the areas of fantasy sports, esports, and real money games. However, the taxation of these platforms…

GST 2.0 and its Impact on Agriculture Sector in 2025

-

- by MI

The agriculture sector has always been central to India’s economy, providing livelihoods to millions of farmers and ensuring food security. With the rollout of GST 2.0…

GST on Renewable Energy: Solar, Wind, and Green Projects in 2025

-

- by MI

India is rapidly moving towards a clean energy future, with ambitious targets for solar, wind, and other green projects. In 2025, GST 2.0 has brought changes that impact…

Impact of GST 2.0 on Logistics and Supply Chain Management in 2025

-

- by MI

The logistics and supply chain sector plays a vital role in India’s economy. With the rollout of GST 2.0 in 2025, the industry is experiencing a major shift in terms of…

Impact of GST on Tourism and Hospitality Industry in 2025 | GST 2.0 Updates

-

- by MI

The tourism and hospitality industry is one of the largest revenue generators in India. With the introduction of GST 2.0 in 2025, significant changes have been made to…

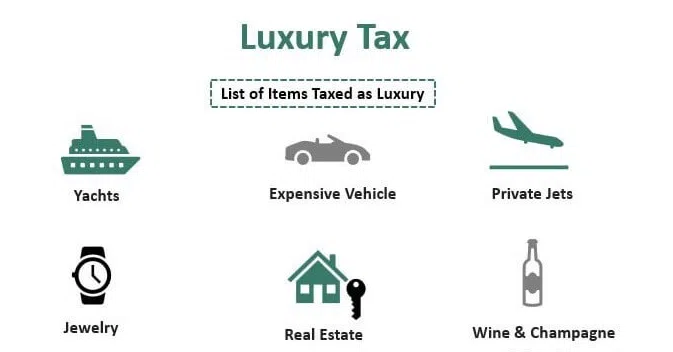

GST on Luxury Goods: What Has Changed in 2025

-

- by MI

Explore GST changes on luxury goods in 2025. Learn about updated GST rates, impact on prices of luxury cars, watches, jewelry, and compliance rules under GST 2.0.

GST Audits Made Easy: Tips for Smooth Compliance

-

- by MI

Step-by-step GST audit guide for businesses in 2025. Learn audit requirements, common mistakes, compliance checklist, and tips for smooth GST audit filing.

GST 2.0 for the Pharmaceutical Industry: Price and Compliance Changes

-

- by MI

Explore the impact of GST 2.0 on the pharmaceutical industry in 2025. Learn about price changes, GST rates on medicines, and compliance requirements for pharma companies.

Impact of GST on Retail Pricing in India: Before and After

-

- by MI

Understand the impact of GST on retail pricing in India. Compare before and after GST prices for consumer goods, electronics, automobiles, and more under GST 2.0.

GST and Cryptocurrency in 2025: What Investors Must Know

-

- by MI

Explore GST on cryptocurrency in 2025 under GST 2.0. Learn tax implications, compliance rules, and important updates for crypto investors in India.

GST on Digital Services in 2025: Updates and Compliance Tips

-

- by MI

Learn about GST on digital services in 2025 under GST 2.0. Updates, compliance tips, and guidelines for businesses providing digital and online services in India.

Common GST Filing Mistakes and How to Avoid Them in 2025

-

- by MI

Filing GST correctly is crucial for businesses to avoid penalties and ensure smooth compliance. With GST 2.0 in 2025, many businesses are still making avoidable mistakes…

How GST 2.0 Is Making E-Invoicing Mandatory for SMEs in 2025

-

- by MI

Learn how GST 2.0 is making e-invoicing mandatory for SMEs in 2025. Step-by-step guide on compliance, benefits, and how small businesses can adopt e-invoicing.

Understanding Reverse Charge Mechanism (RCM) in GST 2.0

-

- by MI

The Reverse Charge Mechanism (RCM) under GST 2.0 is a key provision that shifts the liability to pay tax from the supplier to the recipient. This system ensures…

How to Claim Input Tax Credit (ITC) Under GST 2.0: Step-by-Step Guide

-

- by MI

Learn how to claim Input Tax Credit (ITC) under GST 2.0 in 2025. Step-by-step guide for businesses, eligibility, and tips for faster ITC claims.

GST Refund Process in 2025: Step-by-Step Guide for Businesses

-

- by MI

Under GST 2.0 in 2025, claiming refunds has become more streamlined and digitalized. Businesses can now process refunds faster, with automated validations reducing…

GST 2.0 Tax Rates 2025 | Percentage of GST Slabs Explained

-

- by MI

The introduction of GST 2.0 in 2025 has simplified India’s taxation system. One of the major updates is the revised GST percentage slabs applied to goods and services.…

How GST Impacts the Price of Gold and Jewelry in 2025

-

- by MI

Gold and jewelry hold a special place in Indian households, both as an investment and a tradition. With the rollout of GST 2.0 in 2025, buyers and jewelers are curious…

Future of GST in India: Digitalization, Automation, and Beyond

-

- by MI

The Goods and Services Tax (GST) has been one of the most significant tax reforms in India. With GST 2.0 on the horizon and rapid adoption of technology, the future of…

How GST 2.0 Will Change the Way Businesses File Returns in 2025

-

- by MI

The introduction of GST 2.0 in 2025 marks a new era in India’s taxation system. One of the biggest reforms under GST 2.0 is the simplification of return filing.…

GST 2.0 Car Price List 2025 | Before and After Price Comparison of Maruti, Hyundai, Tata, Mahindra, Honda

-

- by MI

The introduction of GST 2.0 has brought noticeable changes in the automobile sector. Car buyers and manufacturers are closely tracking the new tax rates, which affect…

Automobile Prices in India 2025: Trends, Factors, and Buyer’s Guide

-

- by MI

The Indian automobile industry is one of the fastest-growing markets in the world. With rising demand for cars, bikes, and electric vehicles, consumers are keenly…

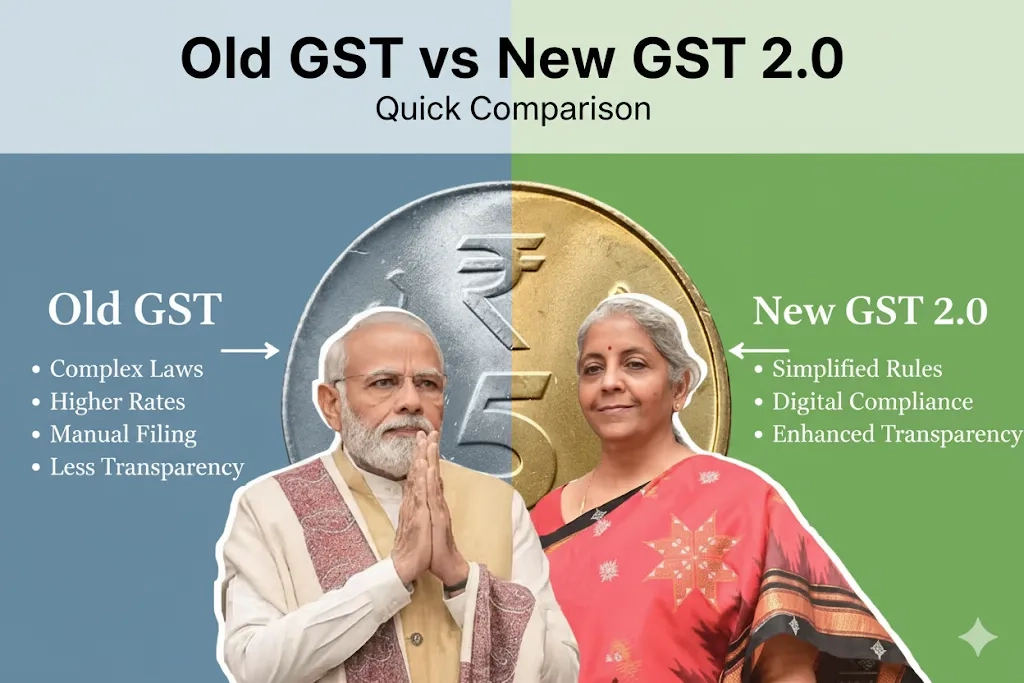

GST vs GST 2.0: Key Differences, Features, and Impact on Indian Businesses

-

- by MI

The Goods and Services Tax (GST), introduced in India in July 2017, was one of the biggest tax reforms in the country’s history. While GST streamlined the indirect tax…

GST 2.0 in India: Key Features, Benefits, and Impact on Businesses in 2025

-

- by MI

The Goods and Services Tax (GST) transformed the Indian taxation system when it was first implemented in 2017. Over the years, businesses and policymakers have…

GST 2.0 India 2025: Complete Guide for Exporters and Businesses to File Returns and Get Refunds

-

- by MI

Learn about GST 2.0 in India, its key updates for 2025, how it affects exporters and businesses, filing processes, and practical tips to stay compliant.

Comments

Add new comment