GST 2.0 and Ease of Doing Business: Benefits for MSMEs

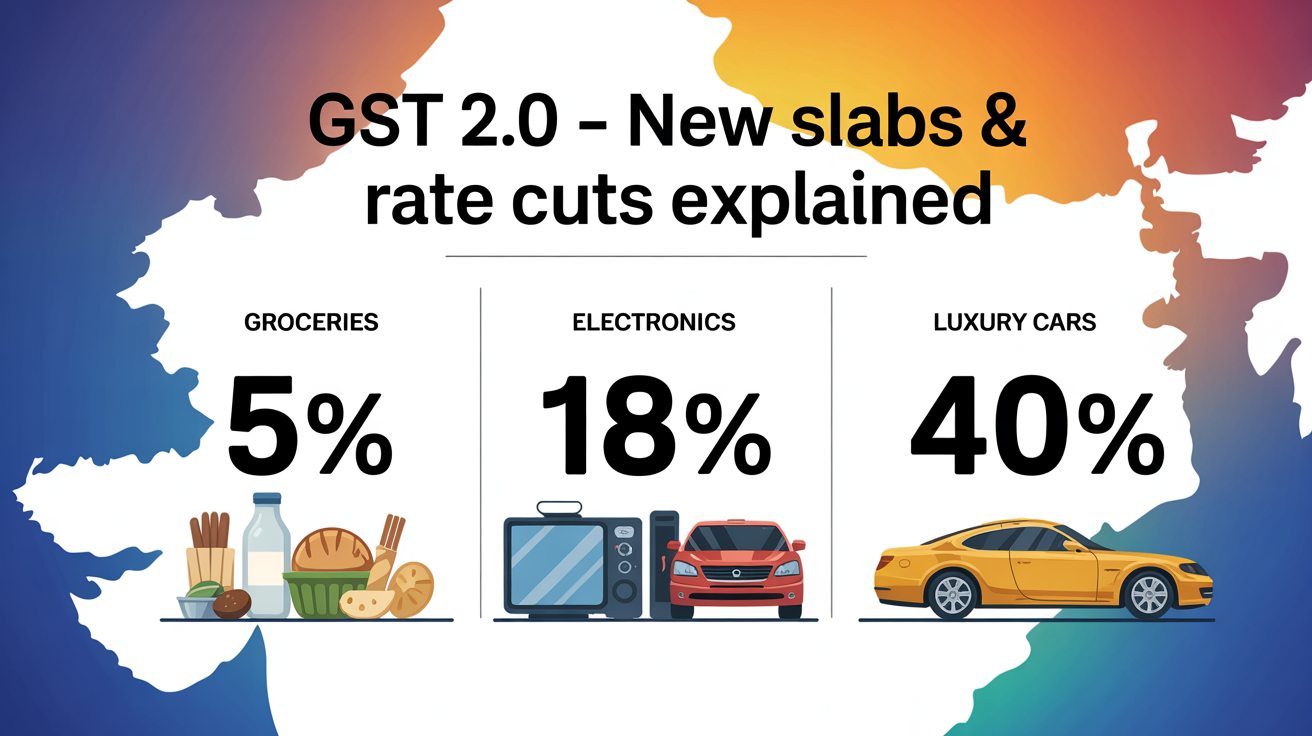

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India’s economy, contributing nearly 30% to GDP and employing millions. However, compliance and taxation have often been major challenges for these businesses. With the introduction of GST 2.0 in 2025, the government aims to simplify taxation and make it easier for MSMEs to grow, compete, and expand.

Key Benefits of GST 2.0 for MSMEs

- Simplified Registration: One-time digital GST registration across states for easier business expansion.

- Lower Compliance Burden: Quarterly filing for small taxpayers reduces paperwork.

- Faster Refunds: MSME exporters benefit from real-time refund processing, improving cash flow.

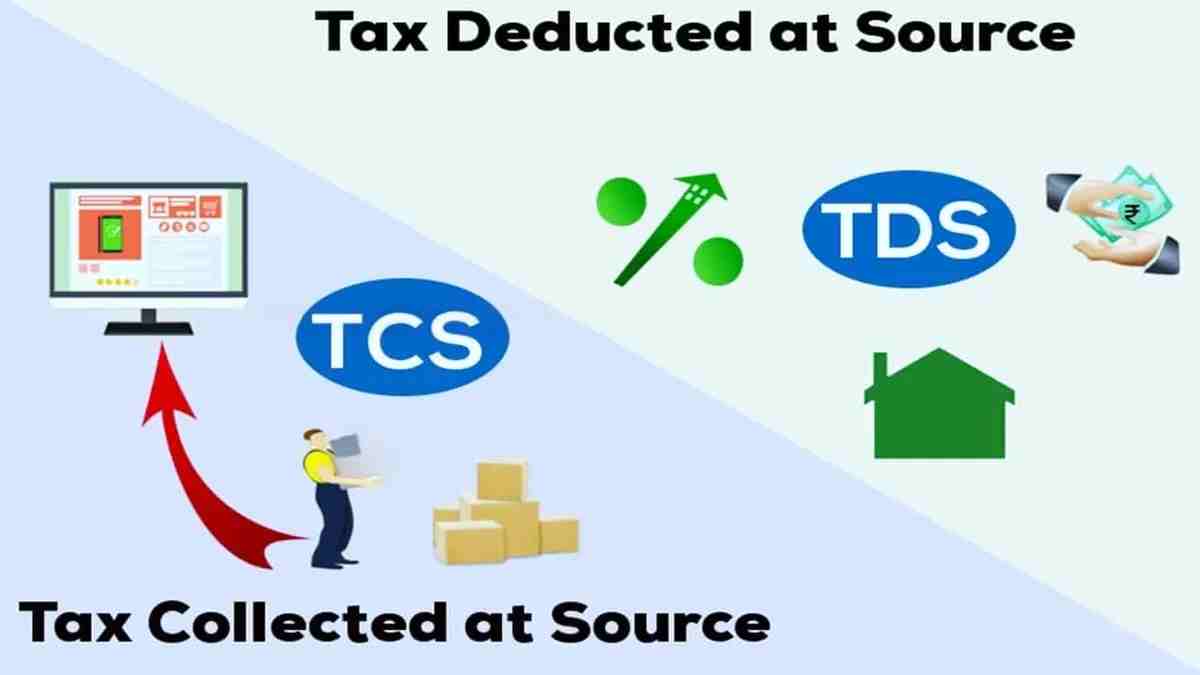

- Input Tax Credit (ITC): Easy ITC claims reduce costs of raw materials and services.

- Digital Filing: AI-powered error detection helps MSMEs avoid penalties.

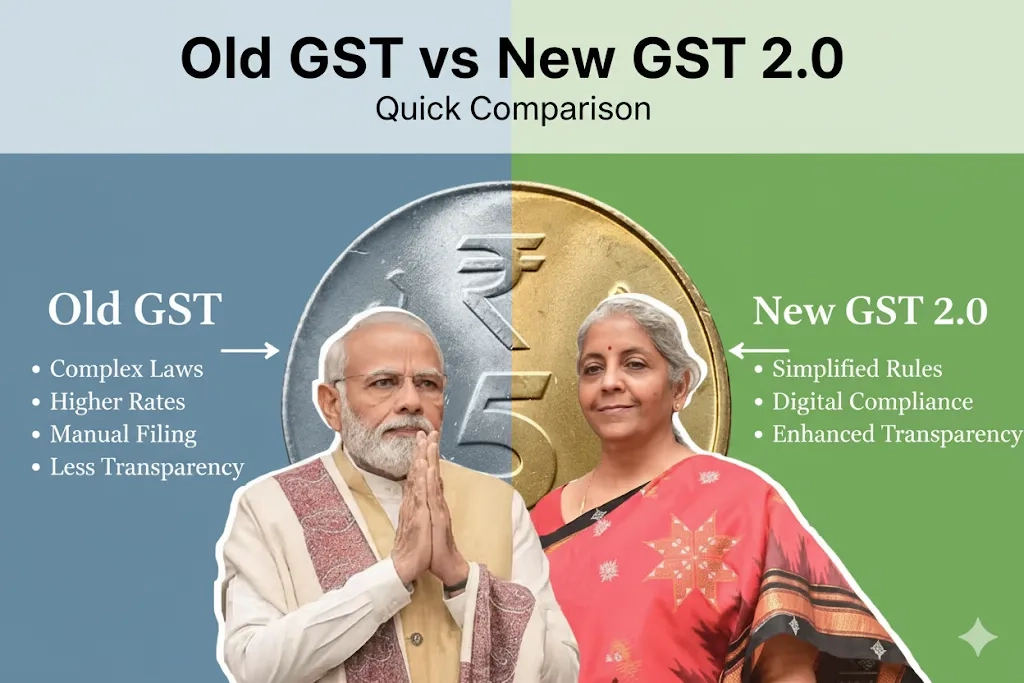

GST 2.0 vs GST 1.0: What Has Changed for MSMEs?

| Feature | GST 1.0 | GST 2.0 (2025) |

|---|---|---|

| Registration | Separate registrations required for each state. | One-time digital registration valid across India. |

| Return Filing | Monthly returns for most businesses. | Quarterly returns for MSMEs with lower turnover. |

| Refund Process | Refunds often delayed, manual verification. | Automated, real-time refunds with minimal manual intervention. |

| Input Tax Credit | Complex ITC claims with mismatches common. | Seamless ITC verification with automated reconciliation. |

| Technology Use | Basic online filing with manual corrections. | AI-powered digital filing with error detection. |

| Compliance Cost | High for micro and small businesses. | Reduced due to simplified returns and digital tools. |

GST 2.0 and MSME Working Capital

One of the biggest hurdles for MSMEs has been blocked working capital due to delayed refunds. GST 2.0 addresses this by introducing:

- Real-time ITC verification.

- Automated refund credits.

- Reduced manual intervention for faster processing.

Impact on Different MSME Segments

| MSME Segment | GST 2.0 Benefits |

|---|---|

| Manufacturers | Reduced tax on raw materials, easier inter-state trade. |

| Exporters | Zero-rated exports, instant refunds, improved global competitiveness. |

| Retailers | Simplified billing, easier ITC claims, better inventory tracking. |

| Service Providers | Lower compliance costs, digital invoicing, simplified returns. |

Challenges for MSMEs under GST 2.0

- Small businesses in rural areas face digital adoption challenges.

- Frequent GST rule updates may cause confusion without professional help.

- Higher compliance costs for very small businesses below certain turnover thresholds.

Future Outlook: GST 2.0 and MSME Growth

By making compliance digital, reducing refund delays, and lowering costs, GST 2.0 aims to create a business-friendly ecosystem for MSMEs. This reform could help India improve its Ease of Doing Business ranking and strengthen MSMEs to become globally competitive.

Conclusion

GST 2.0 and ease of doing business for MSMEs are closely connected. With simplified registration, faster refunds, and digital-first compliance, GST 2.0 ensures that small businesses can focus more on growth and less on paperwork. For MSMEs, this is a crucial step toward sustainable expansion in 2025 and beyond.

Comments

Add new comment