GST on Agricultural Exports: Cotton, Rice, and Spices Explained

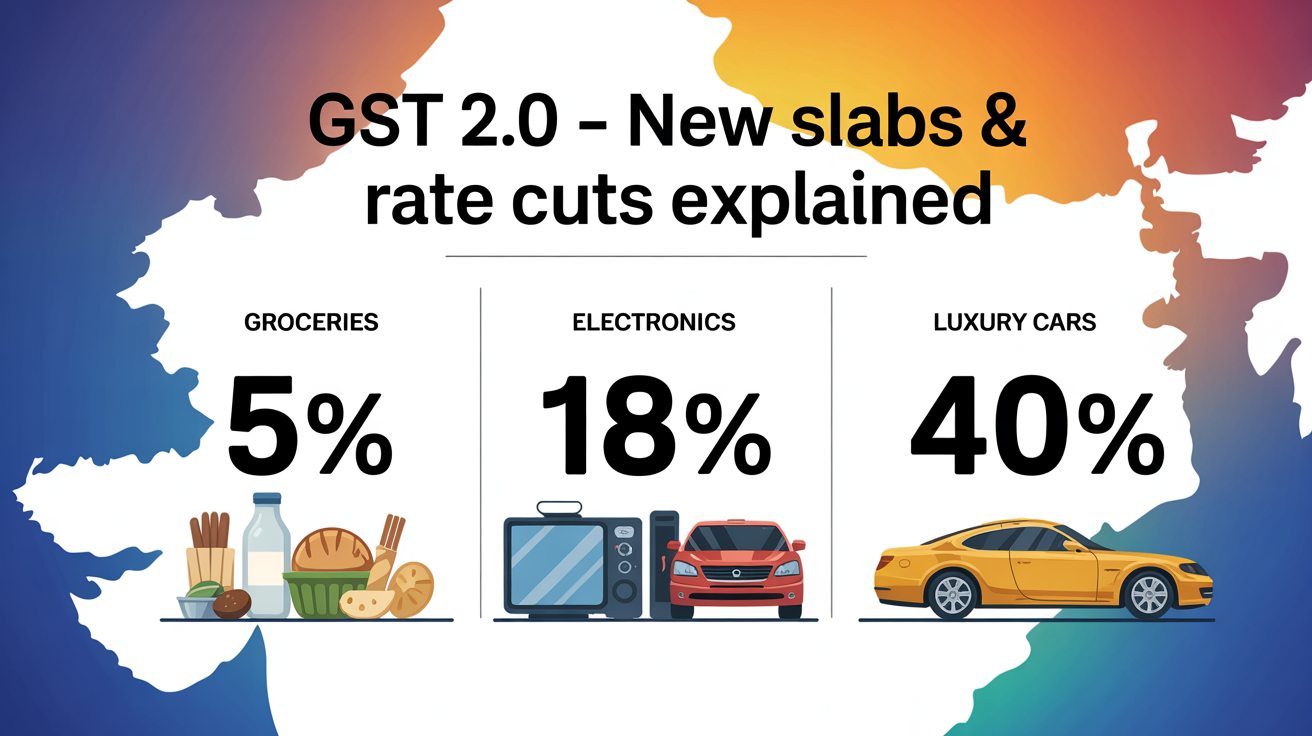

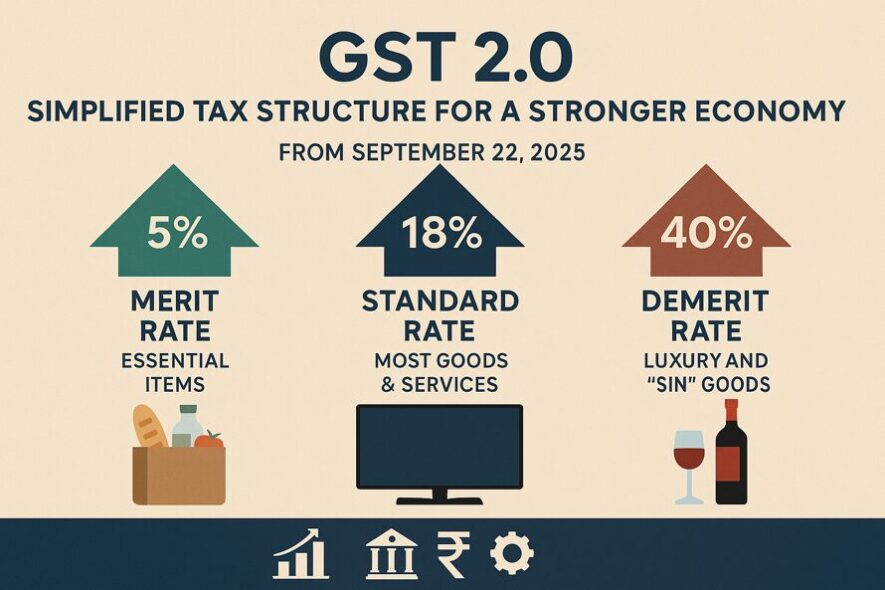

Agriculture has always been the backbone of India’s economy, and agricultural exports like cotton, rice, and spices play a significant role in foreign trade. With GST 2.0 in 2025, exporters must understand the tax treatment, exemptions, and refund processes applicable to agro-commodities. This guide explains the GST rules for key agricultural exports.

1. GST on Cotton Exports

- Raw Cotton: Generally attracts 5% GST in the domestic market. However, when exported, it is considered zero-rated supply under GST.

- Export Benefit: Exporters can claim Input Tax Credit (ITC) refund on inputs used in cotton production.

- Impact: Boosts India’s position as the world’s second-largest cotton exporter.

Example: A textile exporter shipping cotton bales abroad pays no GST on the exports but can claim refund on GST paid for fertilizers, pesticides, or ginning services.

2. GST on Rice Exports

- Non-Basmati Rice: Exempt from GST in domestic trade and also zero-rated for exports.

- Basmati Rice: No GST on exports, though domestic sales may attract minimal GST in value-added forms.

- Impact: Ensures Indian rice exporters remain globally competitive.

Example: Exporting 10,000 tons of basmati rice does not attract GST, but exporters can claim ITC refunds on packaging and logistics costs.

3. GST on Spices Exports

- Raw Spices: Domestic GST rates vary between 5% and 12% depending on the spice (e.g., turmeric, cardamom, pepper).

- Exports: Treated as zero-rated supplies, meaning no GST is charged.

- Refund Claim: Exporters can get a refund of GST paid on inputs such as processing, storage, or packaging.

Example: Exporting ground turmeric incurs no GST on export, but ITC can be claimed on grinding and packaging services.

4. Comparative GST Treatment of Agricultural Exports

| Commodity | Domestic GST | Export GST | Refund Eligibility |

|---|---|---|---|

| Cotton | 5% on raw cotton | Zero-rated | Yes, ITC refund available |

| Rice (Basmati & Non-Basmati) | Exempt (basic form) | Zero-rated | Yes, on inputs like packaging & logistics |

| Spices | 5–12% depending on spice | Zero-rated | Yes, refund on processing/packaging inputs |

5. Exporter Compliance in 2025

- File export details under GSTR-1 and claim ITC in GSTR-3B.

- Choose between export with IGST payment (refund later) or export under LUT (without IGST).

- Maintain proper invoices, shipping bills, and input tax records for refund claims.

Conclusion

In 2025, GST on agricultural exports such as cotton, rice, and spices continues to follow the principle of zero-rated supplies. Exporters don’t pay GST on exports but can claim refunds on input taxes. This ensures Indian agricultural commodities remain globally competitive while supporting farmers and traders with smooth compliance under GST 2.0.

Comments

Add new comment