GST on Petroleum Products: Will It Come Under GST in 2025?

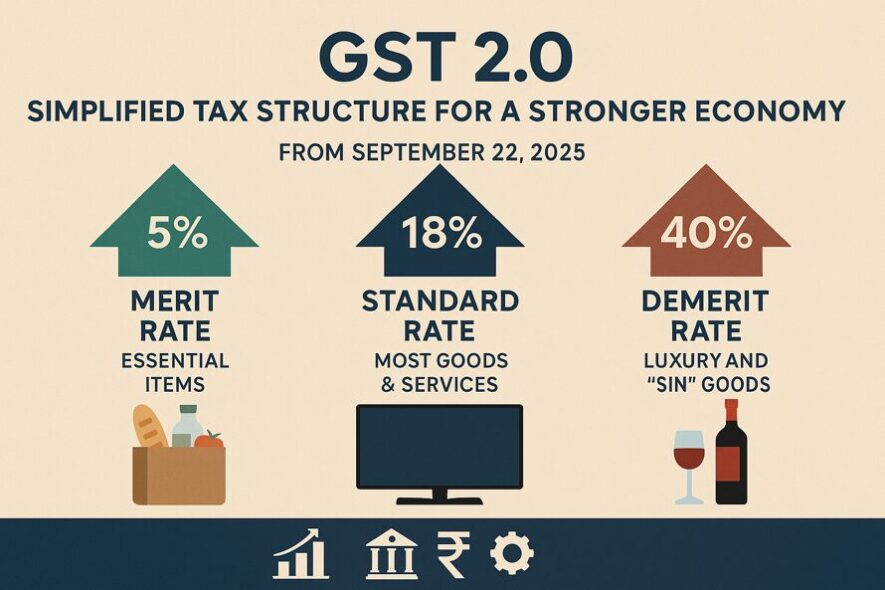

One of the most debated topics in India’s taxation system is whether petroleum products like petrol, diesel, LPG, and natural gas should be brought under the ambit of GST (Goods and Services Tax). As of now, petroleum is kept outside GST, with states levying their own VAT and excise duties, leading to high and uneven fuel prices. In 2025, with GST 2.0 reforms, the question resurfaces – will petroleum products finally come under GST?

Current Tax Structure on Petroleum Products

- Excise Duty: Levied by the central government on petrol, diesel, and crude oil.

- State VAT: States impose VAT, leading to varied fuel prices across states.

- Other Cesses: Additional surcharges like road and infrastructure cess add to costs.

Why Petroleum is Outside GST?

The government has kept petroleum products outside GST because:

- States depend heavily on VAT collections from fuel for revenue.

- Including petrol and diesel in GST may cause massive revenue losses for both center and states.

- Fuel prices are politically sensitive and directly linked to inflation.

What if Petroleum Comes Under GST in 2025?

If petroleum products are brought under GST in 2025, the following changes may occur:

- Lower Fuel Prices: A GST slab of 18%–28% could reduce petrol and diesel costs significantly compared to current taxation of 100%+ in some states.

- Uniform Pricing: Fuel prices will become consistent across India, ending state-to-state variation.

- Boost for Businesses: Logistics, supply chain, aviation, and transport sectors will benefit from reduced fuel costs.

- Revenue Challenge: Governments may face challenges compensating for lost revenue.

Possible GST Rates for Petroleum Products

| Petroleum Product | Possible GST Rate (2025) | Current Taxation |

|---|---|---|

| Petrol | 28% + cess | Excise duty + VAT (~100% effective tax) |

| Diesel | 28% + cess | Excise duty + VAT (~70% effective tax) |

| LPG (Domestic) | 5%–12% | Subsidized, lower taxation |

| Natural Gas | 12%–18% | Currently outside GST, taxed under VAT/excise |

Impact on Consumers and Businesses

- Consumers: Lower fuel costs may reduce household expenses.

- Transport Sector: Logistics and supply chains may see reduced costs, lowering inflation.

- Industries: Manufacturing and aviation may benefit from reduced operational costs.

Government’s Stand in 2025

While discussions on including petroleum in GST are ongoing, the central and state governments are cautious due to revenue dependency. GST 2.0 might bring natural gas and LPG first, followed by petrol and diesel in a phased manner.

Conclusion

The inclusion of petroleum products under GST in 2025 remains uncertain but is seen as a necessary step towards uniform taxation and reduced fuel costs. However, revenue-sharing between the center and states will be the biggest challenge. If implemented, GST on petroleum can reshape India’s economy, logistics, and consumer spending.

Comments

Add new comment